An Unbiased View of Loan Apps

Wiki Article

The Basic Principles Of $100 Loan Instant App

Table of ContentsExcitement About Loan AppsLoan Apps Fundamentals ExplainedSome Known Details About Loan Apps The 20-Second Trick For $100 Loan Instant AppSome Known Questions About Loan Apps.Loan Apps Can Be Fun For Anyone

When we think of looking for finances, the images that enters your mind is people aligning in queues, waiting on countless follow-ups, as well as getting entirely annoyed. But modern technology, as we recognize it, has actually changed the face of the lending company. In today's economic situation, customers as well as not lenders hold the secret.Finance authorization and also paperwork to financing handling, whatever is online. The lots of trusted online finance apps offer consumers a system to get finances quickly and offer authorization in mins. You can take an from a few of the very best money finance apps available for download on Google Play Shop and Application Store.

You just have to download the app or go to the Pay, Sense internet site, subscribe, upload the required records, and your funding will get authorized. You will certainly get alerted when your lending request is processed. Commonly loan application utilized to take at the very least a couple of days. In some instances, the lending approval utilized to get stretched to over a month.

Not known Factual Statements About Loan Apps

Usually, also after getting your lending accepted, the process of obtaining the car loan amount moved to you can require time as well as obtain complicated. That is not the instance with on the internet lending applications that supply a direct transfer alternative. Immediate financing apps use instant individual financings in the variety of Rs.

5,00,000 - loan apps. You can use an immediate lending as per your eligibility as well as need from immediate lending apps. So, you do not have to worry the following time you wish to obtain a small-ticket loan as you know exactly how beneficial it is to take a funding utilizing on the internet funding applications. Do away with the lengthy and tiresome procedure of availing of traditional personal fundings.

Getting The Loan Apps To Work

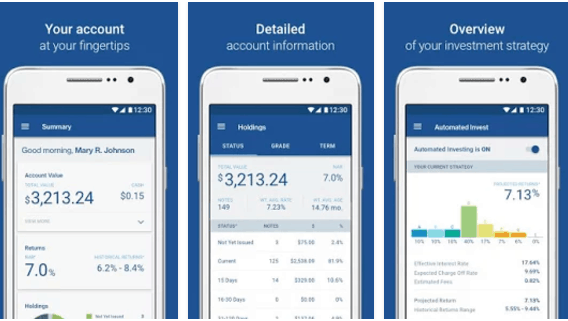

By digitizing and automating the borrowing process, the platform is changing traditional financial institutions right into digital loan providers. In this article, allow's check out the benefits that a digital borrowing system can bring to the table: what's in it for both financial institutions as well as their customers, as well as just how digital lending systems are interfering with the industry.They can even scan the bank declarations for information within only seconds. These features aid to ensure a rapid as well as practical customer experience. The electronic financial landscape is currently more vibrant than ever. Every financial institution currently wants whatever, including lendings, to be refined promptly in real-time. Consumers are no more ready to wait for days - and also to leave their homes - for a financing.

Not known Details About Instant Loan

Today's Gen, Z as well as millennials can not live without their mobile phone. Every one of their daily tasks, including monetary purchases for all their activities and they prefer doing their monetary purchases on it also. They want the convenience of making transactions or making an application for a lending anytime from anywhere. It's extremely hard to please.In this instance, electronic borrowing systems act as a one-stop remedy with little manual information input and also fast turn-around time from loan application to money in the account. Customers ought to be able to relocate flawlessly from one tool to an additional to complete the application, be it the internet as well as mobile interfaces.

Carriers of electronic financing systems are required to make their items in compliance with these policies and also aid the lenders concentrate on their service just. Lenders likewise should make sure that instant cash advance app the providers are updated with all the most recent standards provided by the Regulatory authorities to rapidly include them right into the digital loaning system.

Loan Apps - The Facts

The traditional hands-on loaning system was a pain for both loan provider as well as customer. Consumers had to make multiple trips to the financial institutions and also submit all kinds of files, and also by hand fill out a number of types. instant cash advance app.The Digital Borrowing platform has altered the means banks think of and also apply their finance procurement. Financial institutions can now deploy a fully-digital financing cycle leveraging the most up to date advancements. A terrific electronic loaning system should have simple application submission, quick authorizations, certified borrowing processes, and also the capacity to continually improve procedure performance.

Customers will certainly have to resort to non-bank sources of funding." It is very important to keep in mind that lending is a really successful fintech field, where 28% of the top 50 fintech business operate. So if you're thinking about entering into borrowing, these are calming numbers undoubtedly. At its core, fintech is all about making traditional economic procedures much faster as well as extra reliable.

The 20-Second Trick For Instant Loan

One of the typical misunderstandings is that fintech applications just profit monetary institutions. The application of fintech is now spilling from financial institutions and also lenders to tiny companies. best personal loans., Chief executive officer of the repayment platform Veem, amounts it best: "Little organizations are looking to contract out complexity to someone else due to the fact that they have sufficient to stress about.As you can see, the simplicity of use tops the listing, revealing exactly how availability and benefit given by fintech systems stand for a big motorist for client loyalty. You can apply lots of fintech advancements to drive customer count on as well as retention for businesses.

Report this wiki page